A. Under many situations, a person utilizing your cars and truck with your approval is covered by your insurance coverage. If the individual borrows your auto with your permission and is associated with a crash, your insurance policy will certainly pay as if you were the chauffeur. In some states, some insurers may restrict the protection.

In this example, a young driver can see the price of their insurance policy more than double after one ticket and also one crash. Just to emphasize, the firm made use of far better than average insurance coverage for our price examples, not barebones insurance coverage, so they are not the firm's most affordable costs. All are based on the teen driving a 2003 Honda, normal usage.

If you have an older car with low market price, it may be an excellent concept to lower your premium by removing collision protection. When you offer your automobile to a person and also they trigger an accident, it is their vehicle insurance that will certainly cover the problems on your automobile.

Last Upgraded on July 8, 2021 It is no surprise that insurance coverage for young vehicle drivers can be rather pricey. The majority of 19-year-olds have been driving for a few years, their insurance can still be rather costly.

As young chauffeurs get out on the roadway as well as experience is gained, insurance policy costs will decrease. New York Average It is no secret that vehicle insurance coverage in New York is more pricey than in other states.

Things about How Much Is Car Insurance For A 16-year-old ... - Financebuzz

For a 19-year-old female, on standard, it is $5,462 a year. For a 19-year-old male, it is a standard of $6,458 a year (cheapest). New York is the second a lot more costly state for insuring 19-year-old.

Selecting the ideal car as well as the insurer will influence your costs as well as discount rates used by the insurance policy firm. Choosing the Right Cars And Truck It is not uncommon for a 19-year-old to intend to drive the fastest cars or largest vehicle on the lot, however that will only hurt your insurance coverage premiums.

Debt Score Not many 19-year-olds have a comprehensive debt background to aid reduce insurance policy rates to reveal you are monetarily responsible. cheaper. There are means to construct your credit rating, which will certainly assist lower insurance rates.

cheap car insurance perks risks

cheap car insurance perks risks

In New York, the typical annual price for a 19-year-old is $5960. If you obtain the 9% discount rate, you will certainly pay a standard of $5,424 - business Check over here insurance.

This price cut is usually 15%-30%. Taking an accident avoidance course will certainly offer you a price cut on your vehicle insurance policy rates.

Car Insurance For 19 Year Olds - Bankrate Can Be Fun For Everyone

A Last Word on Insurance Coverage for 19-Year-Olds in NY Insuring a 19-year-old driver is quite pricey, particularly in the state of New York. Taking advantage of the range of price cuts supplied by insurance policy business can aid lower insurance coverage rates.

insurance affordable car insured cars automobile

insurance affordable car insured cars automobile

(And also if you're guaranteeing your teen on your plan, you've currently taken something of a struck so you're just tackling an additional auto and also designating your teenager as the driver.) Right here are some things to think about: What kind of cars and truck would you get? While it's a subjective decision with lots of variables to think about, you may intend to take into consideration the influence your option will certainly have on your cars and truck insurance prices.

However if you decide you intend to go the hybrid cars and truck course, make certain to discover whether there is a hybrid price cut available. You will also wish to get in touch with your insurer before you acquire to ensure the car you're considering won't cost an arm and a leg to insure as a result of its online reputation as being expensive to fix.

You may obtain a discount rate for an automobile that isn't overdoing the miles or used in an extensive work commute. Bundling ways buying more than one kind of insurance policy from the same firm. So, as an example, where readily available, you might acquire both your home and your auto coverage from the exact same insurance firm as well as generally that business will give you a price cut on one or both policies.

Have you gotten various other quotes? Normally, having actually three autos guaranteed with the same company will cost less than splitting them up, yet with a teen driver, that's not an offered. If adding the third lorry with your teen as the primary vehicle driver is also pricey, examine your insurance coverage to make sure it is the very best value for your protection.

What Does Car Insurance For A 19-year-old Mean?

You may get also more of a price cut if all of the motorists in the house take the protective driving course. Great student discount rates are out there, as well.

This discount rate is offered to vehicle drivers who maintain a B average or its equal, or are in the upper 20% of their course scholastically. This coverage offers as well as pays for covered towing and also labor costs if your lorry breaks down.

When it concerns insurance, it pays to be a secure vehicle driver. Teen vehicle drivers currently pay even more for automobile insurance policy than more experienced vehicle drivers, and also if you're not following the guidelines of the roadway, your expenses will certainly be even greater. Insurer consider teenagers a higher risk, since inexperienced drivers are a lot more likely to get into crashes.

Why do I require vehicle insurance? In North Carolina, you are required to have automobile liability coverage to lawfully drive. If you create a mishap, insurance coverage aids pay for injuries and property damages you cause to others.

If you drive without insurance ... You might be ticketed and fined. Your lorry enrollment might be suspended. Your lorry might be seized. As a parent, just how can I keep my teenager motorist secure? If you are a moms and dad of a teen chauffeur, your youngster's security is your very first issue. Though you can not constantly be by their side, there are points you can do to help maintain them safe behind the wheel.

All About Best Car Insurance For Teens And Young Drivers For April 2022

While teen driving data are unpleasant, research study recommends parents who set regulations cut crash risk in fifty percent.

Insurify conducted a research of hundreds of thousands of quotes for teen motorists to figure out the typical monthly price of vehicle insurance coverage, as well as they found that the rates were higher than the average for all other United state

The ordinary full protection automobile insurance coverage price for a 20-year-old man is concerning $3,600. Expense for All 19 years-olds If you're a 19-year-old, you pay high rates for vehicle insurance policy.

The Best Guide To Eligibility And Cost - New York State Department Of Health

The average cost of full insurance coverage for a 19-year-old chauffeur is $3,560, which is greater than $1,800 greater than the nationwide average for drivers age 30. This is because of the fact that they are unskilled as well as have a high rate of mishaps. Resource URL, Resource URL Why is Car Insurance So Costly for 19-year-olds? Vehicle insurance coverage rates vary depending on a variety of demographic details.

The other elements that frequently effect costs are: Marital status, Area, Sex, Credit report, Driving background, Lorry make and model Insurance for a 19-year-old is normally expensive, not only because of the driver's age however various other aspects that likely apply to young adults. Young motorists typically have brief driving histories as well as low credit history scores.

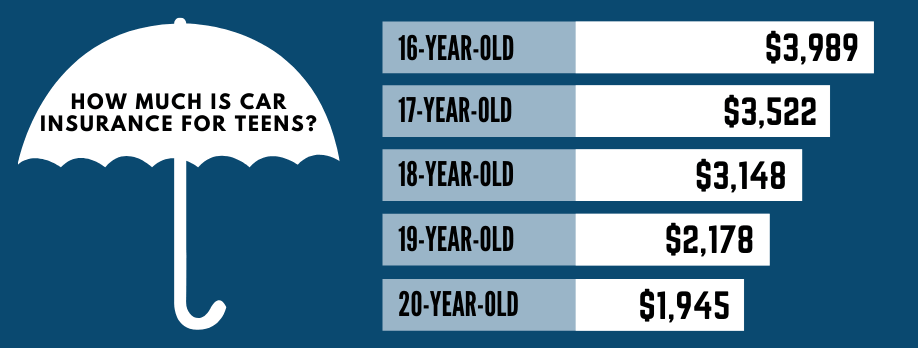

Source link Average Expense for 19-year-olds vs 16-year-olds A 19-year-old will certainly pay about $2,500 much less for car insurance than a 16-year old will - cheap. Source URL Average Price for 19-year-olds vs 18-year-olds Vehicle insurance policy for 19-year-olds is much more costly than it is for the ordinary vehicle driver, but is much less than that of 18-year-old vehicle drivers by themselves policy.

com, Male pay approximately $5,605 for their own complete insurance coverage policy, which is $833 more than females. Source URL, Source link Many Pricey and also Least Expensive States The for 19-year-old motorists is, with an average expense of $1,490 each year for complete coverage and $550 each year for minimal protection.

Both New York as well as New Jersey are no-fault states, and also while New Jacket has the highest possible population density in the country, New York vehicle drivers often drop sufferer to insurance coverage scams.

The Ultimate Guide To Teen Driver? Ways To Cut Insurance, Other Costs - Reuters

Made up of islands, it is not as accessible as various other states. Car Insurance Discounts for a 19-year-old Chauffeur As a 19-year-old chauffeur, you might certify for loads of insurance discount rates.

car insurance cheapest auto insurance cheapest auto insurance cheap

car insurance cheapest auto insurance cheapest auto insurance cheap

You can conserve up to 9% off your auto insurance policy prices. This offers you a typical cost savings of $335. Source URL, Source link Join Your Moms and dad's Plan to Conserve If you have a teen chauffeur that lives with you however has a poor driving document, it's normally more affordable for the teen to be on the parent's policy and also benefit from discount rates that drip down to the teen.

? The university student premiums provided below are a standard of male and female rates with their own policy. accident. Fees decrease swiftly within this automobile insurance policy age bracket; between the ages of 18 as well as 22, trainees can anticipate their premiums to be reduced in fifty percent if they preserve a great driving document.

besides Amica, which doesn't include coverage in Hawaii. Prior to we dive in, below are some things to remember. What to find out about insuring teens and also young motorists, Teenager motorists are those in the 16 to 19 age range, while young person vehicle drivers are between 20 and also 25.

Humana: Find The Right Health Insurance Plan - Sign Up For ... Things To Know Before You Get This

(Teenager young boys have a tendency to be entailed in a lot more significant car accidents than others, and also are more expensive to guarantee.) Premiums normally reduce each year a young chauffeurs gets experience behind the wheel - dui. If you're a parent, as soon as your youngster reaches 18, you'll need to choose whether to buy a different cars and truck insurance coverage policy for your teen or have them detailed on your insurance coverage."It is nearly never more economical to have teenagers listed under their own insurance," claimed Michael Giusti, an analyst at .

prices car insurance cheapest car insure

prices car insurance cheapest car insure

"Putting the teen on a separate policy would not be more economical, but it would keep that history from dragging down the moms and dads' rate," Giusti said. Exactly how do you save cash on auto insurance policy for teens? There are means to reduce insurance costs policy prices. For circumstances, being a safe motorist as well as using more reliable vehicles (such as Honda Civics, Toyota Priuses and Nissan Rogues) tends to reduce costs, also for teenager drivers, according to Giusti.

In contrast, the national averages are clocked in at 834 as well as 909, likewise respectively. To boot, USAA offers competitive prices for those who certify contrasted to various other insurers-- and taking advantage of discount rates makes the rates even extra affordable.

One important point to keep in mind with State Ranch is that the service provider obtains more than 4. 5 times the grievances country wide, according to the NAIC, despite the fact that they have high client fulfillment scores according to J.D. Power - low cost auto. Modern Everybody understands Flo from Progressive, however did you recognize she also has a Twitter account with more than 68,000 fans? That's larger than the Twitter following for Geico's unnamed gecko.

Additionally, the ordinary annual additional costs for full insurance coverage for a 16-year-old is $2,085, which is reduced than the national standard. Progressive has a collection of discounts for households with multiple lorries as well as for both teen motorists and also college trainees.

Fascination About Car Insurance For Teens - Nationwide

Amica made it on our best auto insurance list due to its high client satisfaction scores which is among the factors it also makes this listing. As the earliest shared cars and truck insurer in the US (indicating it's possessed by its insurance holders), Amica has over a century of industry knowledge under its belt.

In addition to standard offerings for young motorists-- consisting of "good trainee" discounts, "student away at school" price cuts and also defensive motorist training program discounts-- Amica offers an unique method to save: a heritage discount. This price cut will request young vehicle drivers under 30 whose parents have had a cars and truck plan with Amica for at the very least 5 years.

Each carrier deals with mishap forgiveness differently, therefore while some carriers may offer you this feature as a complimentary bonus, others might make it a purchasable add-on to your policy. Mishap mercy may not be available in all states, however that depends on the provider, also. car insurance. All of the picks on this listing include some sort of accident forgiveness.

It has not been provided or commissioned by any 3rd party. We might receive compensation when you click on web links to products or solutions provided by our companions.